26Sep2018

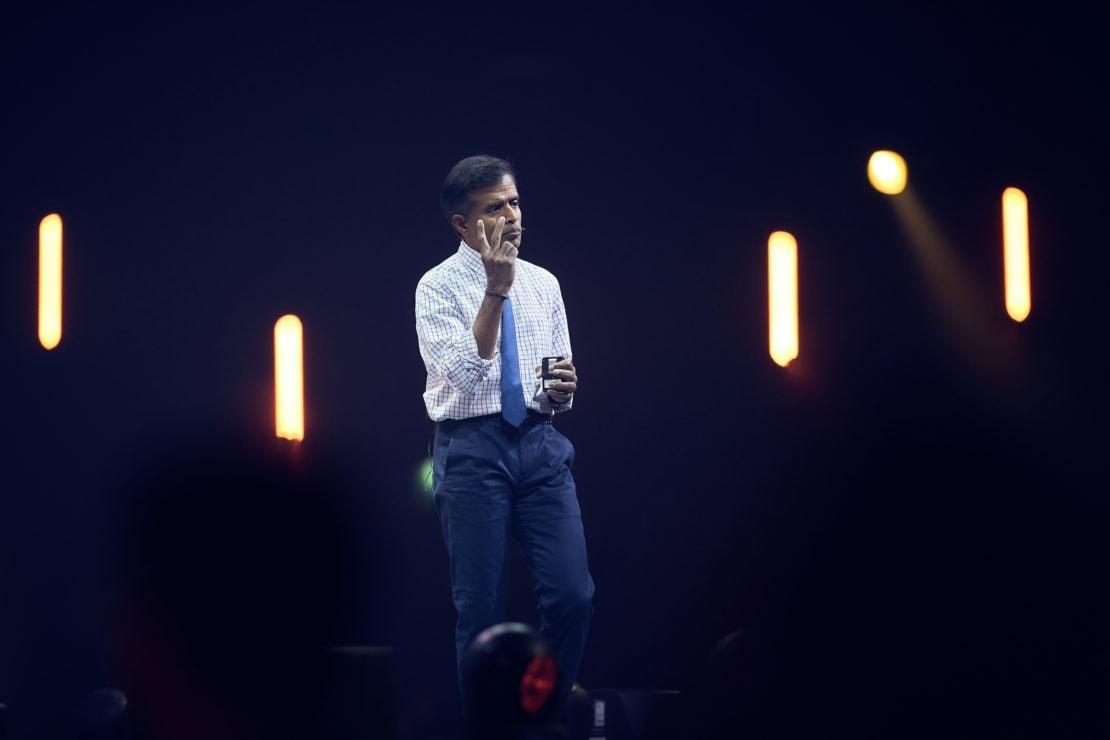

Companies are like people: they are born, mature and like people they decline. And like people, companies don’t always like to act their age, corporate valuation expert Aswath Damodaran declared as he took over the main speaker stage at Nordic Business Forum 2018 in Helsinki.

“More value is destroyed around the world by companies not acting their age. Young companies are trying to act old and old companies are trying to be young again. And there’s an entire ecosystem that feeds these companies. Consultants, bankers are essentially the plastic surgeons of business. If I give you a facelift, you can be young again. And companies keep buying into this notion over and over again.”

Damodaran cited the example of Amazon, which he said is not acting like a mature company but is behaving like a young growth company with USD 1 trillion in market capital behind it. “It’s never been seen before in history and I’m not sure what’s next, but it’s going to be fun watching, but it’s not going to be fun playing against it,” he declared.

Damodaran, who a professor at the Stern School of Business, said that Amazon is difficult to value precisely because it doesn’t act its age. He noted that the conventional wisdom is that Amazon is a retail company, however he said that he has given up on that notion. Now, he said, Amazon can be considered a disruption platform that can effectively target any business on the face of the earth.

When Amazon entered the grocery business, every other business in the sector collectively lost USD40 billion in market capitalization, Damodaran pointed out.

“Amazon is now a disruption platform with an army called Amazon Prime, 100 million absolutely loyal members that they can turn loose on any business they want.”

“Whatever business you’re in, every night get down on your knees and say, ‘Please God, don’t let Amazon come into my business’, because they will destroy your business and leave nothing left,” he quipped.

Damodaran stressed that fighting the corporate life cycle is the most dangerous thing a business can do. During the corporate life cycle from startup to growth to maturity and to decline, a company’s focus also needs to change, its valuation story should also evolve, and the characteristics of a good CEO also depend on the stage the company has reached in its life cycle. At the same time Damodaran argued, the life cycle for companies is becoming compressed particularly in the technology sector.

Damodaran described three fundamental value maximizing principles that firms should apply at different stages of their life cycle. The first is the investment decision, which should be the focus of startups. “Don’t borrow, because you will have to pay interest. You cannot pay interest with potential,” he advised.

Companies in the mature stage of their life cycles should focus on making financing decisions, which involves finding the right balance of equity and debt to minimize the hurdle rate, a reflection of the riskiness of the investment and the required mix of debt and equity needed to finance it.

Finally, firms in decline on the other hand would do well to focus on a dividend decision, meaning that if they cannot find investments to satisfy their hurdle rates, they should return cash to the owners of the business.

Want to dive deeper into the event themes and get to know more in detail what the speakers said at #NBForum2018? Sign up for our newsletter and be the first to receive a copy of our NBForum 2018 Executive Summary to make sure you’re not missing out.