27Dec2017

The global economy is in upheaval, generations are divided, but we shouldn’t be pessimistic.

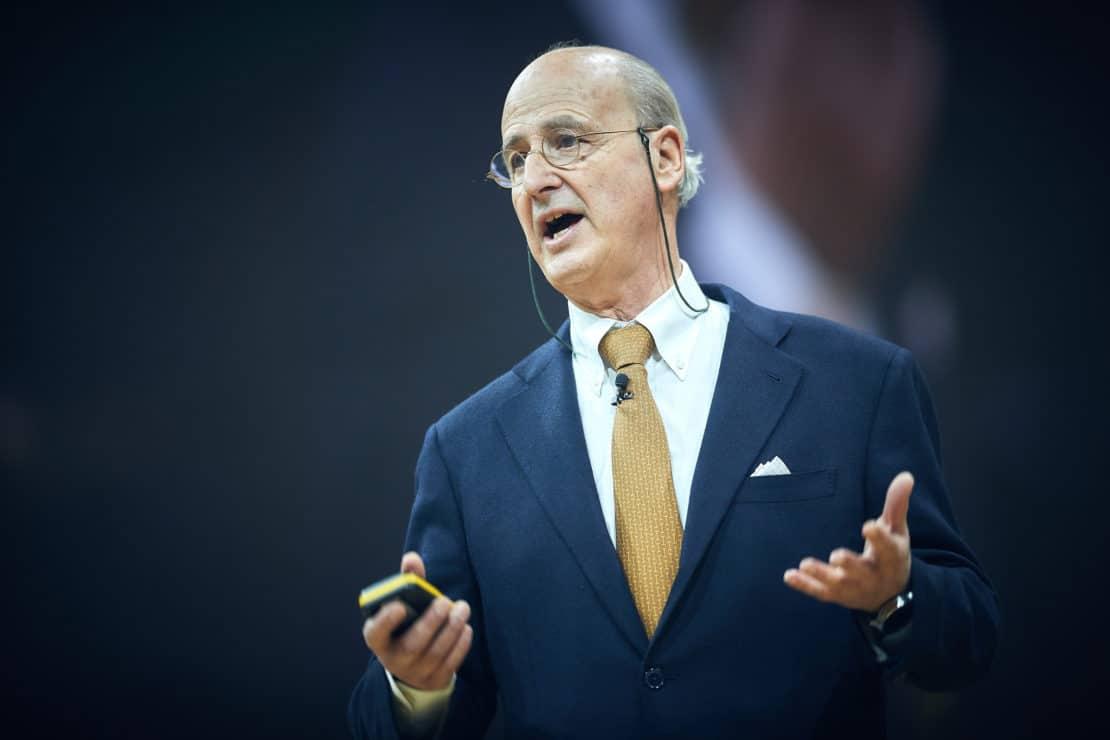

Stéphane Garelli, University of Lausanne’s Emeritus Professor of World Competitiveness and author of Top Class Competitors, took the stage at Nordic Business Forum 2017 and advised the audience to fasten their seatbelts: He had 30 minutes to explain the global economy, review its history, examine its highlights and lowlights, and look to its future.

The world is different

In theory, success is simple. In practice, it’s more complicated. Garelli defines success as the management of efficiency and management of change, including unpredictable factors such as the global environment, technology, and societal values. “The world is interfering with our strategy,” Garelli states. The wild cards, the things outside of one’s control, complicate the path to success.

The global economy is experiencing a synchronized recovery. Europe and the Americas is trending upwards; one of the fastest growing economies is Spain. Garelli jokes, “This was a country that didn’t have a government for eight months! No correlation.”

According to Garelli, this is the first time we’ve seen synchronized recovery, but we can’t relax just yet because the global economy is “very strange.” A large amount of money is created, but inflation is flat. There are massive technological innovations, but productivity doesn’t move. The economy improves, but wages stagnate. Governments run huge debt, but interest rates are low. “When you’re a professor of economy, you don’t know what to teach anymore because it goes exactly in the wrong direction,” Garelli says.

Managing the money

Garelli observes that whenever there is an economic crisis, we look back and ask, “What did Keynes say?” In a nutshell, Keynes’ advice was to print money, build something, and give wages to people so that they will start spending and rebuild the economy. However, now, money has remained in the financial system instead of going to the shops. “We are living in a society which is cash-rich and investment poor,” Garelli argues.

There is a mix of policies: monetary policies are expanding and budget policies are contracting. People ask, “Do we have money or not?” The short answer is, “Yes, some people have money,” and Garelli says that those people need to use it to do something big. “We’re always talking about unemployment of labor, but we also have unemployment of money.”

So, who has money? There’s a wealth of funds in Arab nations, China, Hong Kong, Norway, and Singapore. Also, businesses have money; companies in the US are estimated to have $1.7B and in China $2.1B. “A lot of people have money, but they hide it,” Garelli says.

There are many bids for how to solve this situation. Garelli cites President Trump’s argument that the U.S. should cut corporate taxes, deregulate banks, invest in infrastructure, and spend more on the military. There’s also the matter of large companies sitting on mountains of cash. For Apple and other large U.S. tech companies, a significant part of their profits accumulate abroad. Currently, most of that money is stashed overseas to avoid negative tax consequences of permanently repatriating money to the U.S. Getting that money back to circulation would have a major effect on the global economy, Garelli implies.

Who owns what?

Garelli explained that the magic formula is: globalization + cash + tax optimization = explosions in mergers and acquisitions and consolidation.

“You don’t know what to do with your money abroad? You invest in buying companies,” Garelli says. “In the first half of 2017, there’s been $1,492B spent in this way, which is a record amount.” Another big revolution in corporate ownership is a number of new companies that didn’t exist 15 years ago that are very efficient and making a lot of money.

Garelli tells the audience that they need to learn more about China. In 2016, China spent $225B on outbound mergers and acquisitions, 20 percent of which was made by private companies, not the state. As Garelli explains, there is a lot of money coming in. Japanese conglomerate SoftBank has a private equity fund of $93B to buy companies abroad. Alibaba’s money market fund currently stands at $165B. The question is, “who is doing what?” Companies change and consolidate so much it’s difficult to tell. Amazon is a leader in cloud computing and wants to try its hand at retail food. Alphabet and Facebook own 75 percent of advertising online. Next year, Apple will become one of the leading watch producers in the world. Everything is changing so quickly that the central banks are left asking, “Why can’t we buy shares?” Some do, and Garelli thinks this is disconcerting: “The problem is also that this is not done in full transparency.”

Confronting the “youthquake”

Garelli supported his arguments by sharing his thoughts on millennials and the selfie generation. “This is me-ism,” Garelli continues. “They’re only interested in their own self-fulfillment.” Instead of being active, they escape reality in the world of their smartphones and tablets for over 10 hours a day.

Millennials typically have little religious or political affiliation but are concerned by the state of the world. Garelli quoted Mark Zuckerberg who said, “We have a generational challenge to not only create new jobs but to create a renewed sense of purpose. Not only for yourself, but also for others.” He added that the younger generation seriously wants to improve the state of the world. However, Garelli also calls the younger generations entitled and intrusive. Today, “nothing is confidential anymore.”

“Millennials also have a different attitude for ownership,” Garelli explains. “Free is cool, which is a catastrophe.” We are confronted by a new Faustian bargain, according to Garelli: we are willing to sacrifice all our private information to have access to a free service. Closer reflection might determine that free is in fact very expensive.

Where millennials’ parents are concerned, Garelli states, “Technology is pushing us older ones into new technology.” Their parents are late adopters to platforms that millennials now see as outdated; 33 percent of Facebook users are older than 45 years.

When looking forward, Garelli reminds us that “mindset is critical for competitiveness in the future.” When the younger generation wants to make quick money without putting in the hard work, something will have to change. “We’ll see the younger generation not recognize our value system,” he notes. How are companies supposed to adapt? By making people happy, Garelli suggests. “If you’re a leader and don’t know where you’re going, don’t tell. Just go. And later, tell everyone that’s where you wanted to go.”

Nothing will ever go exactly according to plan, so “stay positive instead of worrying about it all,” Garelli ended.