24Aug2023

On the 23rd of August, we organized a webinar together with Oslo Business Forum and 24SevenOffice with Professor Aswath Damodaran. He discussed living with uncertainty and how businesses can create strategies to deal with uncertainty.

You can watch the webinar recording here until the 23rd of September:

The presentation slides are also available.

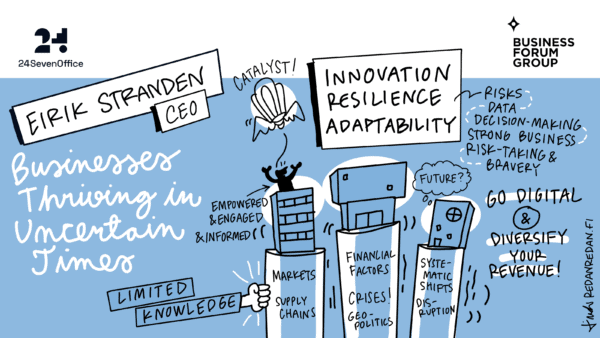

Eirik Stranden of 24SevenOffice: Achieving Growth in Uncertain Times

In the opening session of the webinar, Eirik Stranden, the CEO of 24SevenOffice, shared a blueprint for businesses to thrive and achieve growth in uncertain times. He shared four key takeaways for today’s leaders bracing for the unknown.

- Uncertainty for growth. Historically, uncertainty has inspired innovation. It’s no secret that strategic development is crucial for a company’s growth. Just consider the ways that many companies pivoted operations during the pandemic and the doors these changes opened. (And, on the other hand, how companies that failed to innovate failed to survive.) It comes down to risk-taking and bravery. Some of the most successful leaders are unafraid to seize opportunities and dare to take calculated risks.

- Adaptability and timely decisions. Adaptable businesses don’t just survive—they thrive. Leaders must be agile and adjust their decision-making to rapidly changing circumstances. One way leaders can enhance their agility is to lean into data-driven insights that identify profitable areas, high-return opportunities, or potential inefficiencies. Using data to inform decision-making can help an organization stay ahead of crises.

- Tech-driven diversification. We all know that relying on a single revenue source can be risky. Organizations willing to diversify will be better equipped to mitigate their vulnerabilities and enhance their stability. Leveraging digital solutions for survival in uncertain times can open new avenues to growth in related industries or adjacent markets. It can also drive efficiencies and increase productivity and effectiveness.

- People at heart. Businesses must put their people first. This is crucial for the well-being of employees and the overall health of your organization. Ensure proper information sharing, empower decision-making, and gather feedback. Develop your leaders, invest in your high performers, and keep your people motivated. More than any other factor, people ultimately make or break a company’s success.

Sketchnote by Linda Saukko-Rauta

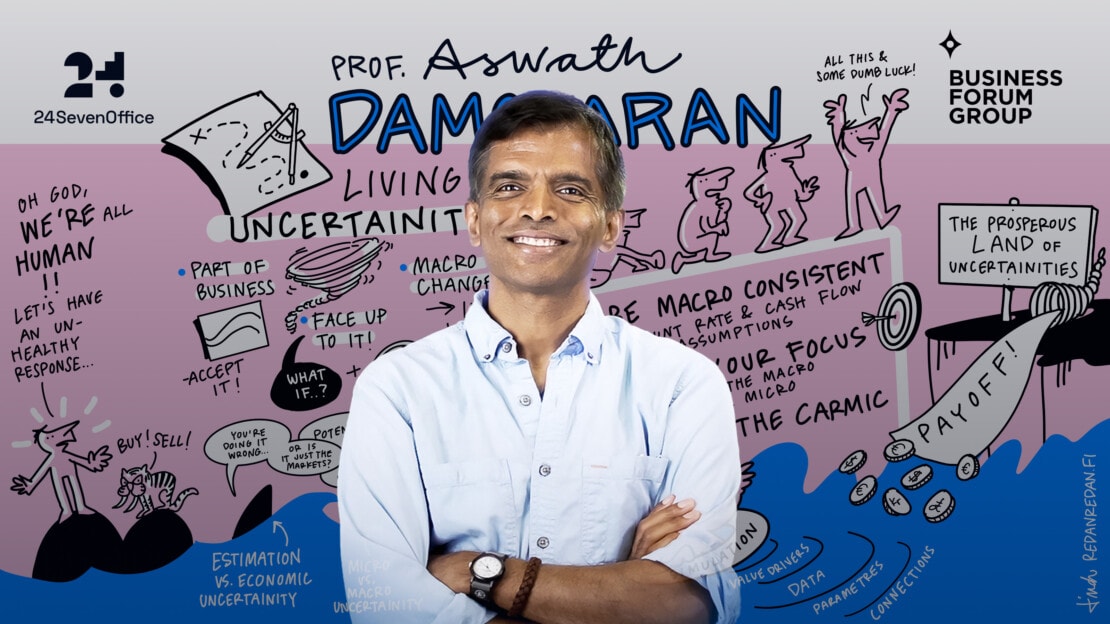

Living with Uncertainty: Investing and Valuation in the Face of the Unknown

Aswath Damodaran is widely known as the finance world’s ‘Dean of Valuation.’ He is a professor of finance at the Stern School of Business at New York University, where he teaches corporate finance and equity valuation. As the author of multiple books on valuation, corporate finance, and investment management, Aswath is regarded as a great teacher and authority.

During the webinar, Aswath shared his insights on living with uncertainty and navigating economic storms. His secrets to handling financial ups and downs can help business leaders make smarter decisions in the face of the unknown.

Uncertainty in the business context

For many leaders, fear is the first word that comes to mind when they think of uncertainty. We are afraid of the unknown, and it can lead to debilitating paralysis.

But in today’s business context, this simply doesn’t work. Leaders must be equipped to face uncertainty and steer their organizations through challenges. No one understands the importance of embracing the unknown like Aswath Damodaran.

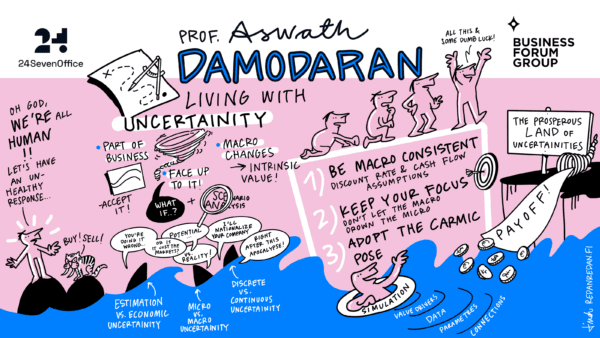

In this session, Aswath discussed:

- The sources of uncertainty

- The unhealthy ways we deal with uncertainty as investors and business leaders

- How to embrace uncertainty in business decision-making

Responding to uncertainty

“Every generation thinks it is special.”

Just reflect on the past few years. How often have we heard someone say, “We’ve never lived in times like these”? And while it may be true that things have changed, there is always one constant: uncertainty.

Our reaction to uncertainty has also not changed much over time. Aswath explained the most common responses to feeling uncertain:

- Paralysis and denial. Uncertainty may stop us in our tracks, or we may hide from it.

- Mental shortcuts. We may fall back on simplistic rules, or follow rules of thumb.

- Herding. When we don’t know what to do, we may look for cues from the crowd.

- Outsourcing. We may push uncertainty onto someone else’s plate, like a consultant.

- Divine intervention. It may be a natural response to pray for a sign.

Aswath believes we must fight the impulse to rely on any of these responses. “The best way to deal with uncertainty,” he said, “Is to live in the world you are in rather than the world you wish you were in.”

Not all risk is created equal

Aswath believes the first step in dealing with uncertainty is understanding that not all risk is equal. He described three categories of uncertainty that business leaders must be aware of.

- Estimation vs. economic uncertainty. Estimation uncertainty refers to the possibility that you could have the wrong model or inputs to your company’s valuation. Economic uncertainty comes from changing markets and economies—and even the best models can fail to capture these unexpected changes.

- Micro-uncertainty vs. macro-uncertainty. Micro uncertainty refers to uncertainty about the potential market for a company’s products or services, the competition it may face, or the capabilities of its management team. Macro uncertainty refers to unexpected changes in the broader economic environment that can affect a company’s ability to thrive.

- Discrete vs. continuous uncertainty. Discrete uncertainty refers to risks that may lie dormant for a period of time and then rear up unexpectedly, such as competitive threats or the failure of regulatory approvals. Continuous uncertainty refers to ongoing risks that create impact as they happen, such as changes in interest rates or the economy.

Acceptance is the key

Aswath’s advice to business leaders who are navigating uncertainty revolves around one key theme: acceptance. Acknowledging the reality that uncertainty is an unavoidable aspect of business is the foundation of building resilience. With that in mind, Aswath offered three insights to help leaders develop the right mindset.

Uncertainty is part of business, with changing contours

Aswath believes leaders must recognize how uncertainty evolves over the lifecycle of a business and be ready to accept different types and levels of uncertainty at different inflection points. For example, young companies (start-ups) face tremendous uncertainty, and much of it is micro uncertainty regarding market readiness or competitive threats. Over time, the concern can shift to macro uncertainty about how the external environment may impact the company’s success. He pointed out that uncertainty will show up in your business drivers, including things like revenue growth, operating margins, growth and investment efficiency, cost of equity, and cost of debt.

Face up to uncertainty

Aswath doesn’t believe in outsourcing uncertainty. A healthier response is for business leaders to embrace the unknown and dive into action. He advises leaders to clarify how they feel about their valuation inputs and why. To do this, it is important to conduct multiple analyses, asking what-if questions and considering correlations. Aswath encourages leaders who are facing up to uncertainty to analyze different scenarios. He shared examples of company valuations he has conducted that accounted for a dozen different stories. One of the most memorable was his valuation of easyJet, which he modeled with two different assumptions: Brexit or no Brexit. This macro factor produced two very different scenarios for the company.

Macro changes can move your intrinsic value

Aswath reminded business leaders that they must be aware of how changes in the macro environment can alter their company’s intrinsic value. Shifts in economic indicators, regulatory frameworks, technological trends, and geopolitical factors can significantly alter a company’s value. Consider how these external factors may impact demand for products or services, the competitive landscape, and internal cost structures. When leaders fail to incorporate and adapt to these macro changes, they are prone to misvaluing their company and misaligning with the broader business environment. An up-to-date understanding of the macro context is essential for accurate valuation and for making informed decisions about the company’s strategic direction.

The 6 Steps of Value Simulation

- Do a base case valuation. Use expected values for inputs.

- Identify the key value drivers. Consider value sensitivity what-ifs and investor fears and disagreements.

- Collect data on value drivers. Use both historical data and cross-sectional data.

- Choose probability distributions and parameters for value drivers.

- Build in constraints and connections.

- Run simulations. Work in value percentiles and value distribution.

The bottom-line rules for company valuation

Aswath shared two firm rules he believes all business leaders must apply when navigating uncertainty in a company’s valuation.

Rule #1: Be macro consistent

Aswath insists that business leaders must be consistent in their discount rate and cash flow assumptions. For example, your company will be overvalued if you build higher expectations of inflation and real growth into your cash flows than you incorporate into your discount rates. Likewise, your company will be undervalued if you build lower expectations of inflation/growth than you incorporate into your discount rate.

It is more important to be consistent in your inflation and growth assumptions than it is to be correct.

Rule #2: Keep your focus

Aswath often reminds business leaders that they must not let the macro drown out the micro. When valuing your company, it’s important to remember what drives that value—as well as what you can and cannot control. For example, Aswath said, “Wasting your time thinking about a nuclear war is not healthy.”

Remain macro-neutral in your company valuations. If you have macro views, they should be provided separately.

Why bother?

Aswath is commonly faced with this question from leaders: “This is a lot of work. Why should I even bother?”

He believes leaders and their organizations should “bother” because there is a payoff in uncertainty. He encouraged leaders to “jump in when others are jumping out.”

“Don’t go into denial, don’t outsource it, don’t act like it’s not there,” Aswath said. “Accept it, be with it.” This is the healthiest way to deal with uncertainty.

During a brief question and answer session at the close of his talk, Aswath offered refreshing perspectives on why some companies are better positioned to thrive in uncertainty compared to others, what might be the next revolution in the business world, and the role innovation plays in assessing a company’s ability to thrive. The most important takeaway from Aswath’s closing remarks may be this:

“There is no one rulebook. You have to figure out your own pathway.”

Sketchnote by Linda Saukko-Rauta